NVDA

From Zero To $1,000,000 Retirement Dividend Portfolio

This article was written by Follow I’m a Financial Analyst at a Fortune 500 company, investing with a long runway—30 years to retirement and plenty of compounding ahead. I write about building a thoughtful portfolio that balances strong growth potential with solid fundamentals. My focus is on high-quality businesses, mostly in the U.S. and Europe—companies […]

AMD: 200% Price Jump Meets Q3 2025 Earnings (Rating Downgrade) (NASDAQ:AMD)

This article was written by Follow Small deep value individual investor, with a modest private investment portfolio, split approx. 50%-50% between shares and call options. I have a B.Sc. in aeronautical engineering and over 6 years of experience as an engineering consultant in the aerospace sector. The latter statement is not relevant in any way […]

Why I'm Downgrading AMD Ahead Of Earnings? (Preview)

Why I'm Downgrading AMD Ahead Of Earnings? (Preview)

Eaton Stock: My Favorite Second Derivative AI Investment Is A Buy (NYSE:ETN)

This article was written by Follow Michael Fitzsimmons is a retired electronics engineer and avid investor. He advises investors to construct a well-diversified portfolio built on a core foundation of a high-quality low-cost S&P500 fund. For investors who can tolerate short-term risks, he advises an over-weight position in the technology sector, which he believes is […]

FDVV ETF: A Rising Star Or Risky Bet For Dividend Growth Investors? (NYSEARCA:FDVV)

This article was written by Follow I’m pursuing financial independence and deleveraging my emergency fund by investing in stocks, real estate, and private businesses to own my income. I require high conviction in my portfolio of dividend-paying stocks and ETFs, which I select based on their risk-adjusted performance, diversification, and sustainability to ensure peace of […]

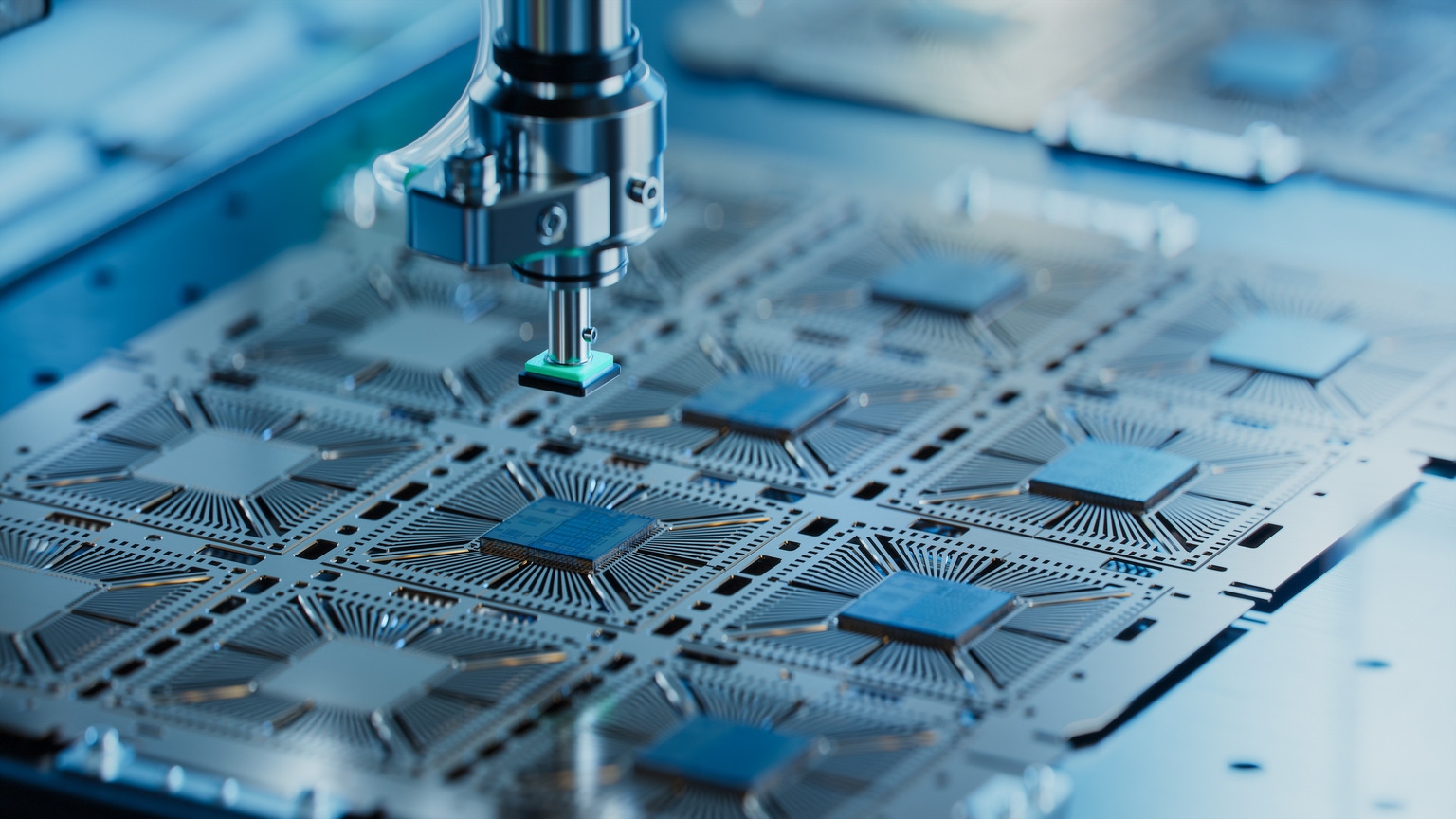

BE Semiconductor: Expensive Now, But Its AI Chip Packaging Leadership Makes It Cheap Later

BE Semiconductor: Expensive Now, But Its AI Chip Packaging Leadership Makes It Cheap Later

From Magnificent To Stretched: Rethink U.S. Equity Allocations

This article was written by Follow VanEck’s mission is to offer investors intelligently designed investment strategies that capitalize on targeted market opportunities. VanEck seeks to provide long-term competitive performance through active and index strategies based on creative investment approaches and portfolio delivery.At VanEck we are driven by innovation, our hallmark since the company’s founding in […]

TSMC: Expecting Strong Q3 FY2025 Earnings, And Tariff Threat Looks Overblown (NYSE:TSM)

This article was written by Follow I’m specialized in fundamental equity research, global macro strategy, and top-down portfolio construction. I’m a senior analyst at a multi-strategy hedge fund with 7 years of experience. I graduated from UCLA with a degree of Business Economics and UMich Ross School of Business with a Master of Accounting. My […]

NVDU: Amplified Exposure To NVDA Shares (NASDAQ:NVDU)

This article was written by Follow Monte Independent Investment Research: Michael Del Monte is a buy-side equity analyst with over 5 years of industry experience. Prior to working in the investment management industry, Michael spent over a decade in professional services working across industries that include O&G, OFS, Midstream, Industrials, Information Technology, EPC Services, and […]

October Dogs Of The Dow Flash One Ideal ‘Safer’ Dividend Buy

This article was written by Follow Fredrik Arnold is a former quality service analyst. He is now reporting investment ideas with a primary focus on dividend yields by utilizing free cash flow and one-year total returns as trading indicators. He is the leader of the investing group The Dividend Dog Catcher, where he shares a […]